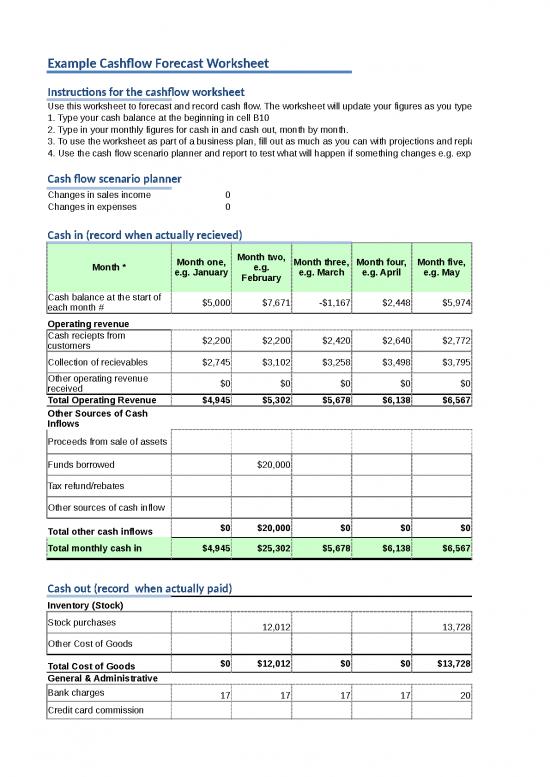

| Example Cashflow Forecast Worksheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Instructions for the cashflow worksheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Use this worksheet to forecast and record cash flow. The worksheet will update your figures as you type. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1. Type your cash balance at the beginning in cell B10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2. Type in your monthly figures for cash in and cash out, month by month. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3. To use the worksheet as part of a business plan, fill out as much as you can with projections and replace these with real figures when you have them. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4. Use the cash flow scenario planner and report to test what will happen if something changes e.g. expenses go up by 5%, |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flow scenario planner |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in sales income |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in expenses |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash in (record when actually recieved) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Month * |

Month one, e.g. January |

Month two, e.g. February |

Month three, e.g. March |

Month four, e.g. April |

Month five, e.g. May |

Month six, e.g. June |

Month seven, e.g. July |

Month eight, e.g. August |

Month nine, e.g. September |

Month ten, e.g. October |

Month eleven, e.g. November |

Month twelve, e.g. December |

Total |

|

Enter your bank balance for the start of the month in cell reference B3

Cash balance at the start of each month # |

$5,000 |

$7,671 |

-$1,167 |

$2,448 |

$5,974 |

-$3,248 |

$1,240 |

$6,213 |

$2,661 |

$7,303 |

$13,093 |

-$1,116 |

|

| Operating revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash reciepts from customers |

$2,200 |

$2,200 |

$2,420 |

$2,640 |

$2,772 |

$2,860 |

$3,080 |

$3,168 |

$3,212 |

$3,300 |

$3,388 |

$3,080 |

$34,320 |

|

Enter when you estimate to collect monies owed by customers

Collection of recievables |

$2,745 |

$3,102 |

$3,258 |

$3,498 |

$3,795 |

$4,046 |

$4,217 |

$4,475 |

$4,666 |

$4,778 |

$4,891 |

$5,016 |

$48,487 |

|

e.g. Commisions etc

Other operating revenue received |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

| Total Operating Revenue |

$4,945 |

$5,302 |

$5,678 |

$6,138 |

$6,567 |

$6,906 |

$7,297 |

$7,643 |

$7,878 |

$8,078 |

$8,279 |

$8,096 |

$82,807 |

| Other Sources of Cash Inflows |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from sale of assets |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

|

This is where any money borrowed would be entered

Funds borrowed |

|

$20,000 |

|

|

|

|

|

|

|

|

|

|

$20,000 |

| Tax refund/rebates |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Other sources of cash inflow |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Total other cash inflows |

$0 |

$20,000 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$20,000 |

| Total monthly cash in |

$4,945 |

$25,302 |

$5,678 |

$6,138 |

$6,567 |

$6,906 |

$7,297 |

$7,643 |

$7,878 |

$8,078 |

$8,279 |

$8,096 |

$102,807 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash out (record when actually paid) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Inventory (Stock) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock purchases |

|

12,012 |

|

|

13,728 |

|

|

8,580 |

|

|

20,592 |

|

$54,912 |

|

This could include direct wages or freight or any other expense directly related to preparing stock ready for sale

Other Cost of Goods |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Total Cost of Goods |

$0 |

$12,012 |

$0 |

$0 |

$13,728 |

$0 |

$0 |

$8,580 |

$0 |

$0 |

$20,592 |

$0 |

$54,912 |

| General & Administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bank charges |

17 |

17 |

17 |

17 |

20 |

18 |

20 |

20 |

18 |

20 |

18 |

18 |

220 |

| Credit card commission |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Accounting/Legal/Consultant fees |

|

|

|

|

|

|

|

462 |

|

|

|

|

$462 |

| Office Supplies |

22 |

22 |

22 |

22 |

22 |

22 |

27 |

22 |

22 |

22 |

22 |

28 |

$275 |

| License fees |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Business insurance |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Etc. |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Total General & Administrative |

$39 |

$39 |

$39 |

$39 |

$42 |

$40 |

$47 |

$504 |

$40 |

$42 |

$40 |

$46 |

$957 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Marketing & Promotional |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Advertising |

275 |

|

|

275 |

|

|

275 |

|

|

275 |

|

|

$1,100 |

| Promotion - General |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Promotion - Other |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Etc. |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Total Marketing & Promotional |

$275 |

$0 |

$0 |

$275 |

$0 |

$0 |

$275 |

$0 |

$0 |

$275 |

$0 |

$0 |

$1,100 |

| Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Newspapers & magazines |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Parking/Taxis/Tolls |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Entertainment/Meals |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Travel/Accomodation |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Laundry/dry cleaning |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Cleaning & cleaning products |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Sundry supplies |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Equipment hire |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Etc. |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Total Operating Expenses |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

| Motor Vehicle Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fuel |

|

|

|

500 |

358 |

275 |

302 |

330 |

347 |

275 |

198 |

110 |

$2,695 |

| Vehicle service costs |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Tyres & other replacement costs |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Insurance |

|

300 |

|

|

|

|

|

|

|

|

|

|

$300 |

| Registrations |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Total Motor Vehicle Expenses |

$0 |

$300 |

$0 |

$500 |

$358 |

$275 |

$302 |

$330 |

$347 |

$275 |

$198 |

$110 |

$2,995 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Website Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Domain name registration |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Hosting expenses |

|

110 |

|

|

|

|

|

|

|

|

|

|

$110 |

| etc |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Total Website Expenses |

$0 |

$110 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$110 |

| Employment Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Permanent |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries/Wages |

1,230 |

1,230 |

1,230 |

1,230 |

1,230 |

1,230 |

1,230 |

1,230 |

1,230 |

1,230 |

1,230 |

1,230 |

$14,760 |

| PAYE |

260 |

260 |

260 |

260 |

260 |

260 |

260 |

260 |

260 |

260 |

260 |

260 |

$3,120 |

| Superannuation |

135 |

135 |

135 |

135 |

135 |

135 |

135 |

135 |

135 |

135 |

135 |

135 |

$1,620 |

| Other - Employee Benefits |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Recruitment costs |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Total Perm. Employ Exp |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$19,500 |

| Casual |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries/Wages |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| PAYE |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Superannuation |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Other - Employee Benefits |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Recruitment costs |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Total Casual Employ Exp |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

| Workcover Insurance |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Total Employment Expenses |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$1,625 |

$19,500 |

| Occupancy Costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Electricity/Gas |

|

|

|

130 |

|

|

|

130 |

|

|

|

160 |

$420 |

| Telephones |

30 |

54 |

64 |

43 |

36 |

43 |

75 |

26 |

44 |

71 |

33 |

30 |

$549 |

| Property Insurance |

305 |

|

|

|

|

|

|

|

|

|

|

|

$305 |

| Rates |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Rent |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Repair & maintenance |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Waste removal |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Water |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Etc. |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Total Occupancy Costs |

$335 |

$54 |

$64 |

$173 |

$36 |

$43 |

$75 |

$156 |

$44 |

$71 |

$33 |

$190 |

$1,274 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bank Interest |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| GST |

|

|

335 |

|

|

435 |

|

|

1,180 |

|

|

400 |

$2,350 |

|

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Total Other Expenses |

$0 |

$0 |

$335 |

$0 |

$0 |

$435 |

$0 |

$0 |

$1,180 |

$0 |

$0 |

$400 |

$2,350 |

| Other Cash Outflows |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase of assets |

|

20,000 |

|

|

|

|

|

|

|

|

|

|

$20,000 |

|

i.e. Establishment fees

One-off bank fees |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Principal Loan repayments |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

|

e.g. Dividends, repayment of shareholder loans etc

Payments to the owner/s |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Investment of surplus funds. |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Other cash inflows |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

| Total Other Cash Outflows |

$0 |

$20,000 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$20,000 |

| Total monthly cash out |

$2,274 |

$34,140 |

$2,063 |

$2,612 |

$15,789 |

$2,418 |

$2,324 |

$11,195 |

$3,236 |

$2,288 |

$22,488 |

$2,371 |

$103,198 |

| Net difference † |

$2,671 |

-$8,838 |

$3,615 |

$3,526 |

-$9,222 |

$4,488 |

$4,973 |

-$3,552 |

$4,642 |

$5,790 |

-$14,209 |

$5,725 |

|

| Cash balance at the end of each month ‡ |

$7,671 |

-$1,167 |

$2,448 |

$5,974 |

-$3,248 |

$1,240 |

$6,213 |

$2,661 |

$7,303 |

$13,093 |

-$1,116 |

$4,609 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| * You may wish to write in the names of the months under the numbers to keep track. 'Month one' is the month you start the business. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| † Net difference shows if more cash came in, than went out, or vice versa; and how much. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ‡ To get the cash balance (last row), add or subtract the Net difference from the Cash balance at the start of the month (top row). This figure becomes the next month's new cash balance. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Disclaimer: The information contained in this publication is provided for general guidance only. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| The State of Victoria does not make any representations or warranties (expressed or implied) as to the accuracy, currency or authenticity of the information. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| The State of Victoria, its employees and agents do not accept any liability to any person for the information or advice which is provided herein. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Authorised by the Victorian Government, 121 Exhibition Street, Melbourne, 3000. © Department of State Development, Business and Innovation (DSDBI) 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Instructions for the cashflow worksheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Use this worksheet to forecast and record cash flow. The worksheet will update your figures as you type. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1. Type your cash balance at the beginning in cell B14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2. Type in your monthly figures for cash in and cash out, month by month. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3. To use the worksheet as part of a business plan, fill out as much as you can with projections and replace these with real figures when you have them. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4. Use the cash flow scenario planner and report to test what will happen if something changes e.g. expenses go up by 5%, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 5. See a plain English explanation of cash flow and an easy-to-follow worked example on the Financial Management section of the Business Victoria website at http://www.business.vic.gov.au |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flow scenario planner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in sales income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flow worksheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash in (record when actually recieved) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Month * |

Month one |

Month two |

Month three |

Month four |

Month five |

Month six |

Month seven |

Month eight |

Month nine |

Month ten |

Month eleven |

Month twelve |

Total |

|

| Cash balance at the start of each month # |

|

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

| Operating revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash receipts from customers |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Collection of receivables |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

$0 |

$0 |

$0 |

$0 |

|

|

e.g. Commisions etc

Other operating revenue received |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Total Operating Revenue |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Other Sources of Cash Inflows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from sale of assets |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

$0 |

|

| Funds borrowed |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Tax refund/rebates |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

This can include equity contributions, frachise or royality fees received etc.

Other sources of cash inflow |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Total other cash inflows |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Total monthly cash in |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Cash out (record when actually paid) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Inventory (Stock) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock purchases |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Other Cost of Goods |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Total Cost of Goods |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| General & Administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bank charges |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Credit card commission |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Accounting/Legal/Consultant fees |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Office Supplies |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| License fees |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Business insurance |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Etc. |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

$0 |

|

| Total General & Administrative |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Marketing & Promotional |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Advertising |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Promotion - General |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Promotion - Other |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Etc. |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Total Marketing & Promotional |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Newspapers & magazines |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Parking/Taxis/Tolls |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Entertainment/Meals |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Travel/Accomodation |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Laundry/dry cleaning |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Cleaning & cleaning products |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Sundry supplies |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Equipment hire |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Etc. |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Total Operating Expenses |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Motor Vehicle Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fuel |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Vehicle service costs |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Tyres & other replacement costs |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Insurance |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Registrations |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Total Motor Vehicle Expenses |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Website Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Domain name registration |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Hosting expenses |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| etc |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Total Website Expenses |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Employment Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Permanent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries/Wages |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| PAYE |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Superannuation |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Other - Employee Benefits |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Recruitment costs |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Total Perm. Employ Exp |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Casual |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries/Wages |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| PAYE |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Superannuation |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Other - Employee Benefits |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Recruitment costs |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Total Casual Employ Exp |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Workcover Insurance |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

|

| Total Employment Expenses |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Occupancy Costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Electricity/Gas |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Telephones |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Property Insurance |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Rates |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Rent |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Repair & maintenance |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Waste removal |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Water |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Etc. |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Total Occupancy Costs |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Other Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bank Interest |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| GST |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Etc. |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Total Other Expenses |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Other Cash Outflows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase of assets |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

i.e. Establishment fees

One-off bank fees |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Principal Loan repayments |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

e.g. Dividends, repayment of shareholder loans etc

Payments to the owner/s |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Investment of surplus funds. |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Other cash inflows |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Total Other Cash Outflows |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Total monthly cash out |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

| Net difference † |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

| Cash balance at the end of each month ‡ |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

| Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * You may wish to write in the names of the months under the numbers to keep track. 'Month one' is the month you start the business. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| † Net difference shows if more cash came in, than went out, or vice versa; and how much. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ‡ To get the cash balance (last row), add or subtract the Net difference from the Cash balance at the start of the month (top row). This figure becomes the next month's new cash balance. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Disclaimer: The information contained in this publication is provided for general guidance only. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| The State of Victoria does not make any representations or warranties (expressed or implied) as to the accuracy, currency or authenticity of the information. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| The State of Victoria, its employees and agents do not accept any liability to any person for the information or advice which is provided herein. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Authorised by the Victorian Government, 121 Exhibition Street, Melbourne, 3000. © Department Jobs, Precincts and Regions (DJPR) 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Summary estimated cashflow |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Instructions for the cashflow worksheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Use this worksheet to forecast and record cash flow. The worksheet will update your figures as you type. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1. Type your cash balance at the beginning in cell B14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2. Type in your monthly figures for cash in and cash out, month by month. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3. To use the worksheet as part of a business plan, fill out as much as you can with projections and replace these with real figures when you have them. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4. Use the cash flow scenario planner and report to test what will happen if something changes e.g. expenses go up by 5%, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 5. See a plain English explanation of cash flow and an easy-to-follow worked example on the Financial Management section of the Business Victoria website at http://www.business.vic.gov.au |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flow scenario planner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in sales income |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in expenses |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Month * |

Month one |

Month two |

Month three |

Month four |

Month five |

Month six |

Month seven |

Month eight |

Month nine |

Month ten |

Month eleven |

Month twelve |

Total |

|

|

|

|

|

|

|

|

| Cash balance at the start of each month # |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

|

| Cash in (record when actually recieved) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash receipts from customers |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Collection of receivables |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

|

e.g. Commisions etc

Other operating revenue received |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Total Operating Revenue |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Other Sources of Cash Inflows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from sale of assets |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

|

|

|

|

|

|

| Funds borrowed |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

|

|

|

|

|

|

| Tax refund/rebates |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

|

|

|

|

|

|

|

This can include equity contributions, frachise or royality fees received etc.

Other sources of cash inflow |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

|

|

|

|

|

|

| Total other cash inflows |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Total monthly cash in |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Cash out (record when actually paid) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Cost of Goods |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Total General & Administrative |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Total Marketing & Promotional |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Total Operating Expenses |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Total Motor Vehicle Expenses |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Total Website Expenses |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Total Perm. Employ Exp |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Total Casual Employ Exp |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Workcover Insurance |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Total Occupancy Costs |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Total Other Expenses |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Other Cash Outflows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase of assets |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

|

|

|

|

|

|

|

i.e. Establishment fees

One-off bank fees |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

|

|

|

|

|

|

| Principal Loan repayments |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

|

|

|

|

|

|

|

e.g. Dividends, repayment of shareholder loans etc

Payments to the owner/s |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

|

|

|

|

|

|

| Investment of surplus funds. |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

|

|

|

|

|

|

| Other cash inflows |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

|

|

|

|

|

|

| Total Other Cash Inflows |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Total monthly cash out |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

| Net difference † |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

|

| (subtracts the Cash out from Cash in) |

|

|

|

|

|

|

|

|

|

| Cash balance at the end of each month ‡ |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

|

| Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * You may wish to write in the names of the months under the numbers to keep track. 'Month one' is the month you start the business. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| † Net difference shows if more cash came in, than went out, or vice versa; and how much. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ‡ To get the cash balance (last row), add or subtract the Net difference from the Cash balance at the start of the month (top row). This figure becomes the next month's new cash balance. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Disclaimer: The information contained in this publication is provided for general guidance only. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| The State of Victoria does not make any representations or warranties (expressed or implied) as to the accuracy, currency or authenticity of the information. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| The State of Victoria, its employees and agents do not accept any liability to any person for the information or advice which is provided herein. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Authorised by the Victorian Government, 121 Exhibition Street, Melbourne, 3000. © Department Jobs, Precincts and Regions (DJPR) 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|