137x Filetype PDF File size 0.54 MB Source: www.icicidirect.com

Opening Bell

January 16, 2023

Market Outlook Today’s Highlights

Indian markets are likely to open on a flat to positive note Results: Federal Bank

today on the back of positive global cues. Investors are Events: India WPI Inflation

likely to remain cautious as they assess the quarterly

earnings of companies amid global headwinds of high

l

inflation and interest rates. Bel

ng

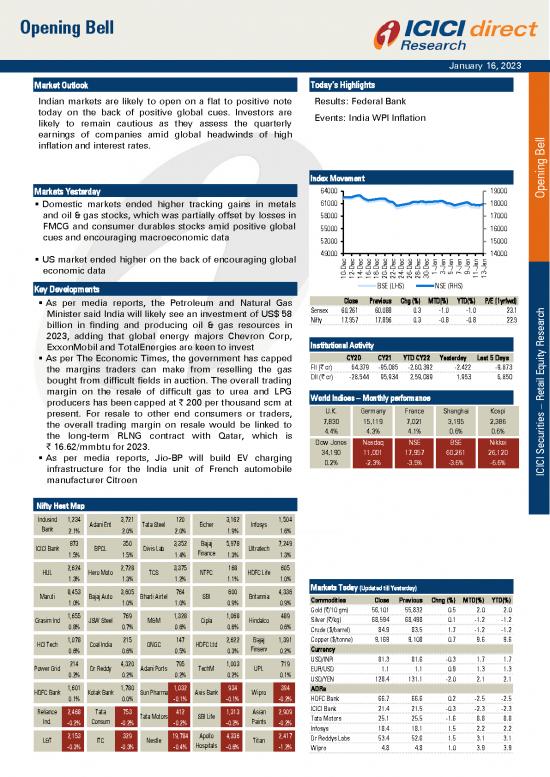

Index Movement

eni

Markets Yesterday 64000 19000

Op

Domestic markets ended higher tracking gains in metals 61000 18000

and oil & gas stocks, which was partially offset by losses in 58000 17000

FMCG and consumer durables stocks amid positive global 55000 16000

cues and encouraging macroeconomic data 52000 15000

49000 14000

c c c c c c c c c c c n n n n n n n

US market ended higher on the back of encouraging global Ja Ja Ja Ja Ja Ja Ja

economic data 0-De2-De4-De6-De8-De0-De2-De4-De6-De8-De0-De1-3-5-7-9-1-3-

1 1 1 1 1 2 2 2 2 2 3 1 1

BSE (LHS) NSE (RHS)

Key Developments

As per media reports, the Petroleum and Natural Gas Close Previous Chg (%) MTD(%) YTD(%) P/E (1yrfwd)

Minister said India will likely see an investment of US$ 58 Sensex 60,261 60,088 0.3 -1.0 -1.0 23.1

billion in finding and producing oil & gas resources in Nifty 17,957 17,896 0.3 -0.8 -0.8 22.9

2023, adding that global energy majors Chevron Corp, search

ExxonMobil and TotalEnergies are keen to invest Institutional Activity Re

y

As per The Economic Times, the government has capped CY20 CY21 YTD CY22 Yesterday Last 5 Days

uit

FII (| cr) 64,379 -95,085 -2,60,392 -2,422 -9,873 q

the margins traders can make from reselling the gas E

bought from difficult fields in auction. The overall trading DII (| cr) -28,544 95,934 2,59,089 1,953 6,850 il

a

margin on the resale of difficult gas to urea and LPG t

World Indices – Monthly performance Re

producers has been capped at | 200 per thousand scm at

present. For resale to other end consumers or traders, U.K. Germany France Shanghai Kospi –

the overall trading margin on resale would be linked to 7,830 15,119 7,021 3,195 2,386 ies

4.4% 4.3% 4.1% 0.6% 0.6%

the long-term RLNG contract with Qatar, which is

| 16.62/mmbtu for 2023. Dow Jones Nasdaq NSE BSE Nikkei

34,190 11,001 17,957 60,261 26,120 Securit

As per media reports, Jio-BP will build EV charging I

0.2% -2.3% -3.5% -3.6% -6.6% C

infrastructure for the India unit of French automobile I

C

I

manufacturer Citroen

Nifty Heat Map

Indusind 1,234 3,721 120 3,162 1,504

Bank Adani Ent Tata Steel Eicher Infosys

2.1% 2.0% 2.0% 1.9% 1.6%

873 350 3,352 Bajaj 5,978 7,249

ICICI Bank BPCL Divis Lab Finance Ultratech

1.5% 1.5% 1.4% 1.3% 1.3%

HUL 2,624 Hero Moto 2,728 TCS 3,375 NTPC 168 HDFC Life 605

1.3% 1.3% 1.2% 1.1% 1.0%

8,453 3,605 764 600 4,336 Markets Today (Updated till Yesterday)

Maruti Bajaj Auto Bharti Airtel SBI Britannia Commodities Close Previous Chng (%) MTD(%) YTD(%)

1.0% 1.0% 1.0% 0.9% 0.9%

Gold (|/10 gm) 56,101 55,832 0.5 2.0 2.0

1,655 769 1,328 1,068 489

Grasim Ind JSW Steel M&M Cipla Hindalco Silver (|/kg) 68,594 68,498 0.1 -1.2 -1.2

0.8% 0.7% 0.6% 0.6% 0.6% Crude ($/barrel) 84.9 83.5 1.7 -1.2 -1.2

1,078 215 147 2,622 Bajaj 1,391 Copper ($/tonne) 9,169 9,108 0.7 9.6 9.6

HCl Tech Coal India ONGC HDFC Ltd Finserv Currency

0.6% 0.6% 0.5% 0.3% 0.2%

214 4,320 795 1,003 719 USD/INR 81.3 81.6 -0.3 1.7 1.7

Power Grid Dr Reddy Adani Ports TechM UPL

0.2% 0.2% 0.2% 0.2% 0.1% EUR/USD 1.1 1.1 0.9 1.3 1.3

USD/YEN 128.4 131.1 -2.0 2.1 2.1

1,601 1,780 1,032 934 394

ADRs

HDFC Bank Kotak Bank Sun Pharma Axis Bank Wipro HDFC Bank 66.7 66.6 0.2 -2.5 -2.5

0.1% 0.0% -0.1% -0.1% -0.2%

ICICI Bank 21.4 21.5 -0.3 -2.3 -2.3

Reliance 2,468 Tata 753 Tata Motors 412 SBI Life 1,313 Asian 2,909

Ind. -0.2% Consum -0.2% -0.2% -0.2% Paints -0.2% Tata Motors 25.1 25.5 -1.6 8.8 8.8

Infosys 18.4 18.1 1.5 2.2 2.2

2,153 329 19,784 Apollo 4,336 2,417

L&T ITC Nestle Titan Dr Reddys Labs 53.4 52.6 1.5 3.1 3.1

-0.3% -0.3% -0.4% Hospitals -0.6% -1.2%

Wipro 4.8 4.8 1.0 3.9 3.9

Opening Bell ICICI Direct Research

Key Data Points Exchange Cash Turnover (| crore)

Key Economic Indicator Period Latest Prior Values 60000 01 46 07 35 73 59

RBI Cash Reserve Ratio N/A 4.50% 4.50% 47, 4,5 4,2 4,3 4,8 6,4

40000 4 4 4 4 4 4

RBI Repo Rate N/A 6.25% 5.90% 5 9 0 8 0 1

RBI Reverse Repo Rate N/A 3.35% 3.35% 20000 ,14 ,94 62 ,94 65 ,89

CPI YY Dec 5.72% 5.88% 3 2 2, 2 2, 3

Current Account Balance Q2 -23.9bln $ -13.4bln $ 0

Exports - USD Nov 31.99bln$ 29.78bln$ 6-Jan 9-Jan 10-Jan 11-Jan 12-Jan 13-Jan

FX Reserves, USD Final Nov 547.25 bln$ 524.52 bln$ BSE Cash NSE Cash

GDP Quarterly yy Q2 6.30% 13.50%

GDP Annual FY22 8.70% -7.30%

NSE Derivative Turnover (| crore)

Imports - USD Nov 55.88 bln $ 53.64 bln $ 60000000 0

Industrial Output yy Nov 7.1% -4.0% 59 3 ,05

0 47 ,1 ,19 01 5

Manufacturing Output yy Nov 6.1% -5.6% 45 ,8 ,39 96 4, 6

Trade Deficit Govt - USD Nov -23.89 bln $ -26.91 bln $ 40000000 1, 74 26 2, ,9 0,7

18, 9, 2, ,0 3 ,2

WPI Food yy Nov 1.1% 8.3% ,2 14, 2 ,12

20000000 1 1

WPI Fuel yy Nov 17.4% 23.2%

WPI Inflation yy Nov 5.9% 8.4% 0

WPI Manuf Inflation yy Nov 3.6% 4.4% 6-Jan 9-Jan 10-Jan 11-Jan 12-Jan 13-Jan

NSE Derivative

Corporate Action Tracker Sectoral Performance –Monthly Returns (%)

Security name Action Ex Date Record Date Status Price (|) Metals 4.0

Tata Consultancy Services Interim Dividend 16-Jan-23 17-Jan-23 8. 00 Oil & Gas 0.3

Tata Consultancy Services Special Dividend 16-Jan-23 17-Jan-23 67 .00 Auto -0.9

HCL Technologies Interim Dividend 19-Jan-23 20-Jan-23 10 .00 Healthcare -1.3

IT -1.9

PSU -2.0

Power -2.5

Capital Goods -2.6

BSE Small Cap -3.1

Banks -3.5

BSE Midcap -4.1

Real Estate -4.3

Consumer Durables -4.3

FMCG -4.6

-6.0 -4.0 -2.0 0.0 2.0 4.0 6.0

(%)

Key News for Today

Company/ News View Impact

Industry

Larsen & L&T has partnered with H2Carrier to The Government of India has approved a

Toubro develop floating green hydrogen projects. plan of incentives worth more than $2 billion

(L&T) L&T has announced it has signed an last week to develop a green hydrogen

agreement with the Norway-based production capacity of 5 million tonnes a

H2Carrier to develop floating green year by 2030. L&T has done different types of

ammonia projects for industrial-scale JVs for green hydrogen production and

applications. H2C plans to build the leveraging its expertise in the energy sector

P2XFloater hull at yards in Asia. It will and has now positioned itself to emerge as a

design and fabricate the topside process green energy major

and utility modules to produce green

hydrogen and green ammonia, including

electrolysers, nitrogen generation plant,

and ammonia synthesis unit. The

companies will now become partners for

EPC, installation and commissioning for

H2C's plants. P2XFloater is an industrial-

scale floating green hydrogen and green

ammonia facility. Further, installation of the

topsides modules on the hull and their

integration can be customised as per

location preferences. It can be carried out

in India or in other geographies

ICICI Securities | Retail Research

Opening Bell ICICI Direct Research

HDFC Bank HDFC Bank beat our estimates on NII and Deposit accretion will remain in focus

PAT front as business growth continued its though the management indicated it will be

healthy traction. Asset quality was steady supported by branch expansion and

QoQ.NII was up 24.6% YoY and 9.4% QoQ relationship building. The bank has not yet

to | 22987 crore (ahead of our estimates of heard from the RBI on its request for certain

| 21834 crore), partly aided by interest in IT regulatory relaxations ahead of the merger

refund (| 300 crore) and steady margins at with HDFC, hence it remains in focus

4.1%. Credit cost of 0.74% vs. 0.87% in

Q2FY23. Net profit for the quarter beat our

estimates at | 12259.5 crore up 18.5% YoY

(resulting in highest RoA at 2.24%). Loan

growth remained healthy with 19.5% YoY.

Deposit accretion was at 19.9% YoY to |

17.3 lakh crore

Anup Q3FY23 revenue increased 142.4% YoY Order book was at | 566 crore (1.5x TTM

Engineerin (+13.3% QoQ) to | 114.4 crore led by revenues) as of December 2022 end, which

g better execution. Strong YoY growth was provides good revenue visibility. Heat

also driven by lower base (Q3FY222 exchangers and vessels contributed 64%

revenue declined 47% QoQ). 9MFY23 and 19% of order book, respectively. On the

revenues up 41.9% YoY (heat exchangers capex front, construction is going on in full

contributed 78%, Vessels 14%). Domestic, swing at Kheda and is likely to get

exports revenue contribution was at 75%, commissioned by Q4FY23. The company

25%, respectively, for 9MFY23. Gross said there is a strong enquiry pipeline in

margin contracted sharply by 1230 bps YoY refining & petrochemical sectors, which

to 48.7% on account of increase in raw contributes ~85% of current order backlog.

material prices. However, EBIDTA margin The management’s focus is expected to

contracted by 316 bps YoY to 19.8%, continue on consistent performance and

supported by positive operating leverage. reducing the skewness of volume between

Sequentially, EBITDA margins remained the quarter. The company is also focusing on

largely flattish. The margins are as per the increasing the orders in export (25% of order

management guidance and sharp recovery book) and exotic metallurgy segment. We

is expected in the coming period. EBIDTA believe Anup Engineering is on the cusp of

increased 109% YoY (+10.6% QoQ) to | entering a new trajectory led by new

19.8 crore led by strong revenue growth. products and capex, which is expected to

9MFY23 EBITDA increased 14.1% YoY. PAT drive strong earnings in the coming period

increased 136.2% YoY (+7.4% QoQ) to |

13.9 crore in Q3FY23 while it was up 8.3%

YoY for 9MFY23

ICICI Securities | Retail Research

Opening Bell ICICI Direct Research

Wipro Wipro’s IT services revenues increased Q3 revenues came in the guided range albeit

0.6% QoQ in CC while dollar revenues on the lower end but margin expansion was

were up 0.2% QoQ to US$2,803.5 mn. a positive surprise. Total TCV number looks

Rupee revenues were up 3.1% QoQ to strong to us and even if it stays at this level

|23,056 crore (vs our expectations of 3.6% for FY24, we are looking at US$13 bn

QoQ) . Vertical wise, in CC terms, growth revenue opportunity in FY25, assuming

was aided by Healthcare & Energy ( 23% conservative book to bill of 0.75x. However,

mix together), which grew 5.5% and 2% order book to revenue conversion is the kay,

QoQ, respectively, while which is yet to meaningfully play out in

BFSI/Communication & Technology vertical Wipro’s case but the management expects

reported decline of 5.9%, 0.6% and 2.4%, this to play out in FY24/FY25. Vendor

respectively. Geography wise in CC terms, consolidation is another area where the

Sequential growth was aided by Europe, company likely to be one of the beneficiaries

which reported 2.4% growth while America in our view. The company also mentioned

and RoW reported weak numbers. IT that 16.3% is the new base for margin and

services margins were up 120 bps QoQ on margins are likely to expand, going forward,

operating efficiencies & shift of some on easing of supply side pressure and lower

resources from FPP to T&M while there was subcontracting costs and it aspires to be in

also a help accounting treatment to the high teen margin trajectory in the

restructuring costs. Attrition was down 180 medium to long term which along with

bps QoQ 21.2% (down 260 bps from peak strong growth could be re-rating for the

in Q4FY22). The company for for the first stock in our opinion

time reported total TCV number for the

quarter, which was US$4.3bn , up 26% YoY

in CC, while large deal order book was at

US$1 bn for Q3, up 69% YoY. The

company is guiding revenue growth for IT

services to be in the range of 11.5% to 12%

in CC terms for FY23

India As per media sources, India has Grade A As per media sources (Anarock), Grade A

warehousi and B warehousing stock of about 350 warehousing assets will witness between

ng sector million sq feet in the top eight cities. 15% and 20% of annual growth over the

Greater supply chain efficiency, rapid e- next three to four years. The growth is

commerce growth, and consolidation positive for 3PL stocks such as TCI, Mahindra

among 3PL providers are all fundamental logistics and Adani Ports (via its subsidiary

market drivers that India increasingly Adani Logistics) in our coverage universe

shares with its counterparts in the US and

Europe

CGDs As per media reports, producers will have Any situation, which may require

to offer natural gas from difficult fields to proportionate distribution of the gas offered

city gas companies ahead of other sectors under the bidding process, the contractor

in case of tied bids in an auction shall offer gas to bidders belonging to

CNG/PNG sector, fertiliser, LPG and power

sector in that order. This would mean CGDs

such as IGL, MGL and Gujarat Gas, which

supply CNG and PNG will enjoy priority over

others

ICICI Securities | Retail Research

no reviews yet

Please Login to review.