318x Filetype XLSX File size 0.06 MB Source: www.fdic.gov

Sheet 1: 1. Instructions

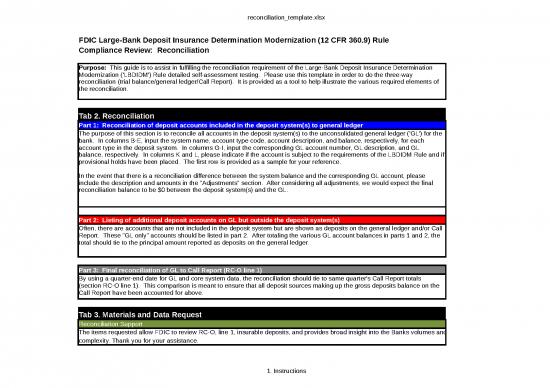

| FDIC Large-Bank Deposit Insurance Determination Modernization (12 CFR 360.9) Rule | |||||||||||

| Compliance Review: Reconciliation | |||||||||||

| Purpose: This guide is to assist in fulfilling the reconciliation requirement of the Large-Bank Deposit Insurance Determination Modernization ('LBDIDM') Rule detailed self-assessment testing. Please use this template in order to do the three-way reconciliation (trial balance/general ledger/Call Report). It is provided as a tool to help illustrate the various required elements of the reconciliation. | |||||||||||

| Tab 2. Reconciliation | |||||||||||

| Part 1: Reconciliation of deposit accounts included in the deposit system(s) to general ledger | |||||||||||

| The purpose of this section is to reconcile all accounts in the deposit system(s) to the unconsolidated general ledger ('GL') for the bank. In columns B-E, input the system name, account type code, account description, and balance, respectively, for each account type in the deposit system. In columns G-I, input the corresponding GL account number, GL description, and GL balance, respectively. In columns K and L, please indicate if the account is subject to the requirements of the LBDIDM Rule and if provisional holds have been placed. The first row is provided as a sample for your reference. In the event that there is a reconciliation difference between the system balance and the corresponding GL account, please include the description and amounts in the "Adjustments" section. After considering all adjustments, we would expect the final reconciliation balance to be $0 between the deposit system(s) and the GL. |

|||||||||||

| Part 2: Listing of additional deposit accounts on GL but outside the deposit system(s) | |||||||||||

| Often, there are accounts that are not included in the deposit system but are shown as deposits on the general ledger and/or Call Report. These "GL only" accounts should be listed in part 2. After totaling the various GL account balances in parts 1 and 2, the total should tie to the principal amount reported as deposits on the general ledger. | |||||||||||

| Part 3: Final reconciliation of GL to Call Report (RC-O line 1) | |||||||||||

| By using a quarter-end date for GL and core system data, the reconciliation should tie to same quarter's Call Report totals (section RC-O line 1). This comparison is meant to ensure that all deposit sources making up the gross deposits balance on the Call Report have been accounted for above. | |||||||||||

| Tab 3. Materials and Data Request | |||||||||||

| Reconciliation Support | |||||||||||

| The items requested allow FDIC to review RC-O, line 1, insurable deposits, and provides broad insight into the Banks volumes and | |||||||||||

| complexity. Thank you for your assistance. | |||||||||||

| Important: Please refer to the "Instructions" tab for assistance filling out this reconciliation. | |||||||||||

| Part 1: Reconciliation of deposit accounts included in the deposit system(s) to general ledger | In scope? | Holds placed? | |||||||||

| System name | Account type code | Account type description | Core deposit balance | GL account number | GL account description | GL balance | (Y/N) | (Y/N) | |||

| Sample: | Sample system1 | 4103 | Interest checking | 423,904,182.00 | 2000001 | NOW accounts | 423,904,182.00 | Y | Y | ||

| Unadjusted total | $423,904,182.00 | $423,904,182.00 | A | ||||||||

| Core to GL difference | $- | ||||||||||

| Adjustments | |||||||||||

| Description | Amount | ||||||||||

| Reconciled difference | $- | Should be 0 | |||||||||

| Part 2: Listing of additional deposit accounts on GL but outside the deposit system(s) | |||||||||||

| GL account number | GL account description | GL balance | |||||||||

| 0 | B | ||||||||||

| A+B | |||||||||||

| Part 3: Final reconciliation of GL to Call Report | |||||||||||

| Total deposits per GL | 0 | GL | |||||||||

| Accrued interest on deposits | 423,904,182.00 | GL | |||||||||

| Total deposits and accrued interest | $423,904,182.00 | ||||||||||

| Call Report balance | RC-O line 1 | ||||||||||

| Difference | Should be 0 | ||||||||||

| Supplemental sweep investment vehicle information | |||||||||||

| System name | Sweep type | GL account | Sweep amount | ||||||||

| Sample | Sample system1 | Offshore | 210500 | 5,000,000.00 | |||||||

no reviews yet

Please Login to review.