152x Filetype XLSX File size 0.10 MB Source: education.qld.gov.au

Sheet 1: Instruction

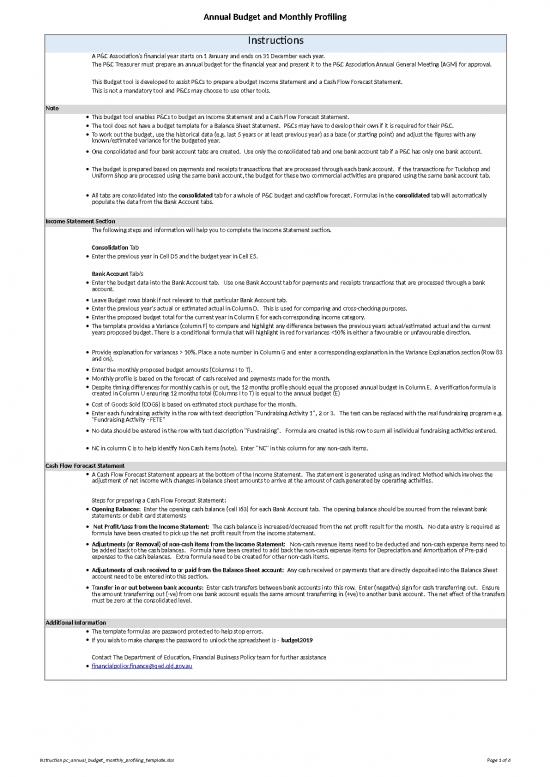

| Instructions | |

| A P&C Association's financial year starts on 1 January and ends on 31 December each year. | |

| The P&C Treasurer must prepare an annual budget for the financial year and present it to the P&C Association Annual General Meeting (AGM) for approval. | |

| This Budget tool is developed to assist P&Cs to prepare a budget Income Statement and a Cash Flow Forecast Statement. | |

| This is not a mandatory tool and P&Cs may choose to use other tools. | |

| Note | |

| • | This budget tool enables P&Cs to budget an Income Statement and a Cash Flow Forecast Statement. |

| • | The tool does not have a budget template for a Balance Sheet Statement. P&Cs may have to develop their own if it is required for their P&C. |

| • | To work out the budget, use the historical data (e.g. last 5 years or at least previous year) as a base (or starting point) and adjust the figures with any known/estimated variance for the budgeted year. |

| • | One consolidated and four bank account tabs are created. Use only the consolidated tab and one bank account tab if a P&C has only one bank account. |

| • | The budget is prepared based on payments and receipts transactions that are processed through each bank account. If the transactions for Tuckshop and Uniform Shop are processed using the same bank account, the budget for these two commercial activities are prepared using the same bank account tab. |

| • | All tabs are consolidated into the consolidated tab for a whole of P&C budget and cashflow forecast. Formulas in the consolidated tab will automatically populate the data from the Bank Account tabs. |

| Income Statement Section | |

| The following steps and information will help you to complete the Income Statement section. | |

| Consolidation Tab | |

| • | Enter the previous year in Cell D5 and the budget year in Cell E5. |

| Bank Account Tab/s | |

| • | Enter the budget data into the Bank Account tab. Use one Bank Account tab for payments and receipts transactions that are processed through a bank account. |

| • | Leave Budget rows blank if not relevant to that particular Bank Account tab. |

| • | Enter the previous year's actual or estimated actual in Column D. This is used for comparing and cross-checking purposes. |

| • | Enter the proposed budget total for the current year in Column E for each corresponding income category. |

| • | The template provides a Variance (column F) to compare and highlight any difference between the previous years actual/estimated actual and the current years proposed budget. There is a conditional formula that will highlight in red for variances <10% in either a favourable or unfavourable direction. |

| • | Provide explanation for variances > 10%. Place a note number in Column G and enter a corresponding explanation in the Variance Explanation section (Row 83 and on). |

| • | Enter the monthly proposed budget amounts (Columns I to T). |

| • | Monthly profile is based on the forecast of cash received and payments made for the month. |

| • | Despite timing differences for monthly cash in or out, the 12 months profile should equal the proposed annual budget in Column E. A verification formula is created in Column U ensuring 12 months total (Columns I to T) is equal to the annual budget (E) |

| • | Cost of Goods Sold (COGS) is based on estimated stock purchase for the month. |

| • | Enter each fundraising activity in the row with text description "Fundraising Activity 1", 2 or 3. The text can be replaced with the real fundraising program e.g. "Fundraising Activity - FETE" |

| • | No data should be entered in the row with text description "Fundraising". Formula are created in this row to sum all individual fundraising activities entered. |

| • | NC in column C is to help identify Non Cash items (note). Enter "NC" in this column for any non-cash items. |

| Cash Flow Forecast Statement | |

| • | A Cash Flow Forecast Statement appears at the bottom of the Income Statement. The statement is generated using an Indirect Method which involves the adjustment of net income with changes in balance sheet amounts to arrive at the amount of cash generated by operating activities. |

| Steps for preparing a Cash Flow Forecast Statement: | |

| • | Opening Balances: Enter the opening cash balance (cell I63) for each Bank Account tab. The opening balance should be sourced from the relevant bank statements or debit card statements |

| • | Net Profit/Loss from the Income Statement: The cash balance is increased/decreased from the net profit result for the month. No data entry is required as formula have been created to pick up the net profit result from the income statement. |

| • | Adjustments (or Removal) of non-cash items from the Income Statement: Non-cash revenue items need to be deducted and non-cash expense items need to be added back to the cash balances. Formula have been created to add back the non-cash expense items for Depreciation and Amortisation of Pre-paid expenses to the cash balances. Extra formula need to be created for other non-cash items. |

| • | Adjustments of cash received to or paid from the Balance Sheet account: Any cash received or payments that are directly deposited into the Balance Sheet account need to be entered into this section. |

| • | Transfer in or out between bank accounts: Enter cash transfers between bank accounts into this row. Enter (negative) sign for cash transferring out. Ensure the amount transferring out (-ve) from one bank account equals the same amount transferring in (+ve) to another bank account. The net effect of the transfers must be zero at the consolidated level. |

| Additional Information | |

| • | The template formulas are password protected to help stop errors. |

| • | If you wish to make changes the password to unlock the spreadsheet is - budget2019 |

| Contact The Department of Education, Financial Business Policy team for further assistance | |

| • | financialpolicy.finance@qed.qld.gov.au |

| XXX State School P&C Association | |||||||||||||||||||

| 20XX P&C Annual Budget and Monthly Profiling Template | |||||||||||||||||||

| Consolidated | |||||||||||||||||||

| Statement of Comprehensive Income | 2018 | 2019 | Note | ||||||||||||||||

| NC | Actual or Estimated Actual |

Budget | Variance | # | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sept | Oct | Nov | Dec | Verification | ||

| Income | |||||||||||||||||||

| Sales Tuckshop | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Sales Uniform Shop | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Sales Bookshop | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Sales Swim Club | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Fundraising | |||||||||||||||||||

| Fundraising Activity 1 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Fundraising Activity 2 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Fundraising Activity 3 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Donations received | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Grant | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Interest earned | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Other Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Total Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Cost of Goods Sold | |||||||||||||||||||

| Costs of Goods Sold - Tuckshop | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Costs of Goods Sold - Uniform Shop | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Cost of Goods Sold - Bookshop | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Total Cost of Sales | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Gross Profit | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Expenses | |||||||||||||||||||

| Accountant fees | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Advertising and marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Audit fees | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Bank charges | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Donations made | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Depreciation | NC | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||

| Equipment/tools | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Fundraising Expenses | |||||||||||||||||||

| Fundraising Activity 1 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Fundraising Activity 2 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Fundraising Activity 3 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Insurance | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Loan repayment - interest expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Membership and subscriptions | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Printing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Amortisation of pre-paid expenses | NC | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||

| Annual Leave | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Long Service Leave | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Repairs and Maintenance | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| School premise/facility hire | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Stationery and postage | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Superannuation | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Wages | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Total Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Net Profit / (Loss) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Cash Flow Forecast | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sept | Oct | Nov | Dec | |||||||

| Opening Balance | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||

| Net Profit/Loss from the Income Statement | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||

| Adjustments (or Removal) of non-cash items from the Income Statement | |||||||||||||||||||

| Less non-cash revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||

| Add non-cash expense - Depreciation expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||

| Add non-cash expense - Amortisation of prepaid expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||

| Adjustments for cash received to or paid from the Balance Sheet account | |||||||||||||||||||

| Add cash received - a new loan | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||

| Less cash paid - prepayment | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||

| Less cash paid - repayment of loan principal component | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||

| Transfer in or out between bank accounts (enter negative ( - ) sign for cash transferring out) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||

| Closing Balance | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||

| Variance Explaination | |||||||||||||||||||

| XXX State School P&C Association | |||||||||||||||||||

| 20XX P&C Annual Budget and Monthly Profiling Template | |||||||||||||||||||

| Bank Account 1 | |||||||||||||||||||

| Statement of Comprehensive Income | 2018 | 2019 | Note | ||||||||||||||||

| NC | Actual or Estimated Actual |

Budget | Variance | # | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sept | Oct | Nov | Dec | Verification | ||

| Income | |||||||||||||||||||

| Sales Tuckshop | |||||||||||||||||||

| Sales Uniform Shop | |||||||||||||||||||

| Sales Bookshop | |||||||||||||||||||

| Sales Swim Club | |||||||||||||||||||

| Fundraising | |||||||||||||||||||

| Fundraising Activity 1 | |||||||||||||||||||

| Fundraising Activity 2 | |||||||||||||||||||

| Fundraising Activity 3 | |||||||||||||||||||

| Donations received | |||||||||||||||||||

| Grant | |||||||||||||||||||

| Interest earned | |||||||||||||||||||

| Other Income | |||||||||||||||||||

| Total Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Cost of Goods Sold | |||||||||||||||||||

| Costs of Goods Sold - Tuckshop | |||||||||||||||||||

| Costs of Goods Sold - Uniform Shop | |||||||||||||||||||

| Cost of Goods Sold - Bookshop | |||||||||||||||||||

| Total Cost of Sales | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Gross Profit | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Expenses | |||||||||||||||||||

| Accountant fees | |||||||||||||||||||

| Advertising and marketing | |||||||||||||||||||

| Audit fees | |||||||||||||||||||

| Bank charges | |||||||||||||||||||

| Donations made | |||||||||||||||||||

| Depreciation | NC | ||||||||||||||||||

| Equipment/tools | |||||||||||||||||||

| Fundraising Expenses | |||||||||||||||||||

| Fundraising Activity 1 | |||||||||||||||||||

| Fundraising Activity 2 | |||||||||||||||||||

| Fundraising Activity 3 | |||||||||||||||||||

| Insurance | |||||||||||||||||||

| Loan repayment - interest expenses | |||||||||||||||||||

| Membership and subscriptions | |||||||||||||||||||

| Printing | |||||||||||||||||||

| Amortisation of pre-paid expenses | NC | ||||||||||||||||||

| Annual Leave | |||||||||||||||||||

| Long Service Leave | |||||||||||||||||||

| Repairs and Maintenance | |||||||||||||||||||

| School premise/facility hire | |||||||||||||||||||

| Stationery and postage | |||||||||||||||||||

| Superannuation | |||||||||||||||||||

| Wages | |||||||||||||||||||

| Other Expenses | |||||||||||||||||||

| Total Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Net Profit / (Loss) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Cash Flow Forecast | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sept | Oct | Nov | Dec | |||||||

| Opening Balance | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||

| Net Profit/Loss from the Income Statement | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||

| Adjustments (or Removal) of non-cash items from the Income Statement | |||||||||||||||||||

| Less non-cash revenue | |||||||||||||||||||

| Add non-cash expense - Depreciation expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||

| Add non-cash expense - Amortisation of prepaid expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||

| Adjustments of cash received to or paid from the Balance Sheet account | |||||||||||||||||||

| Add cash received - a new loan | |||||||||||||||||||

| Less cash paid - prepayment | |||||||||||||||||||

| Less cash paid - repayment of loan principal component | |||||||||||||||||||

| Transfer in or out between bank accounts (enter negative ( - ) sign for cash transferring out) | |||||||||||||||||||

| Closing Balance | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||

| Variance Explaination | |||||||||||||||||||

no reviews yet

Please Login to review.