283x Filetype XLS File size 0.62 MB Source: exinfm.com

Sheet 1: 1 - Control Menu

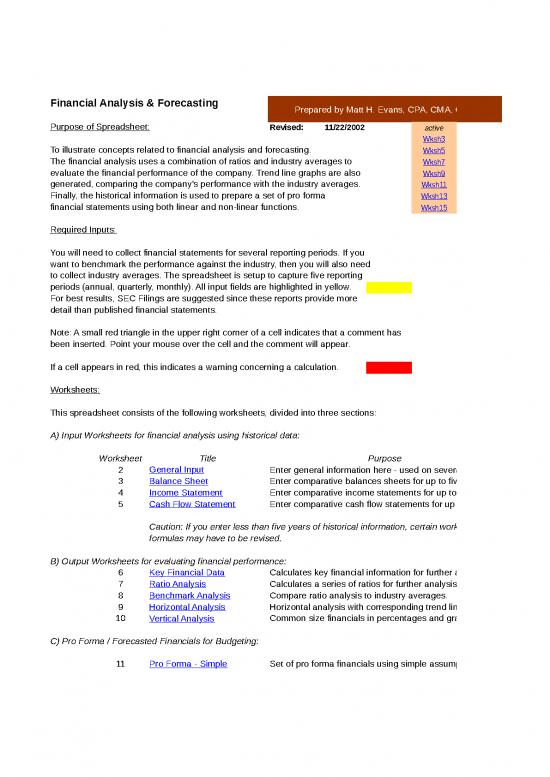

| Financial Analysis & Forecasting | Prepared by Matt H. Evans, CPA, CMA, CFM | ||||||

| Purpose of Spreadsheet: | Revised: | 11/22/2002 |

|

|

|||

|

|

|

||||||

| To illustrate concepts related to financial analysis and forecasting. |

|

|

|||||

| The financial analysis uses a combination of ratios and industry averages to |

|

|

|||||

| evaluate the financial performance of the company. Trend line graphs are also |

|

|

|||||

| generated, comparing the company's performance with the industry averages. |

|

|

|||||

| Finally, the historical information is used to prepare a set of pro forma |

|

|

|||||

| financial statements using both linear and non-linear functions. |

|

|

|||||

| Required Inputs: | |||||||

| You will need to collect financial statements for several reporting periods. If you | |||||||

| want to benchmark the performance against the industry, then you will also need | |||||||

| to collect industry averages. The spreadsheet is setup to capture five reporting | |||||||

| periods (annual, quarterly, monthly). All input fields are highlighted in yellow. | |||||||

| For best results, SEC Filings are suggested since these reports provide more | |||||||

| detail than published financial statements. | |||||||

| Note: A small red triangle in the upper right corner of a cell indicates that a comment has | |||||||

| been inserted. Point your mouse over the cell and the comment will appear. |

|

||||||

| If a cell appears in red, this indicates a warning concerning a calculation. | |||||||

| Worksheets: | |||||||

| This spreadsheet consists of the following worksheets, divided into three sections: | |||||||

| A) Input Worksheets for financial analysis using historical data: | |||||||

| Worksheet | Title | Purpose | |||||

| 2 | General Input | Enter general information here - used on several worksheets. | |||||

| 3 | Balance Sheet | Enter comparative balances sheets for up to five periods. | |||||

| 4 | Income Statement | Enter comparative income statements for up to five periods. | |||||

| 5 | Cash Flow Statement | Enter comparative cash flow statements for up to five periods. | |||||

| Caution: If you enter less than five years of historical information, certain worksheet | |||||||

| formulas may have to be revised. | |||||||

| B) Output Worksheets for evaluating financial performance: | |||||||

| 6 | Key Financial Data | Calculates key financial information for further analysis. | |||||

| 7 | Ratio Analysis | Calculates a series of ratios for further analysis. | |||||

| 8 | Benchmark Analysis | Compare ratio analysis to industry averages. | |||||

| 9 | Horizontal Analysis | Horizontal analysis with corresponding trend lines. | |||||

| 10 | Vertical Analysis | Common size financials in percentages and graphs. | |||||

| C) Pro Forma / Forecasted Financials for Budgeting: | |||||||

| 11 | Pro Forma - Simple | Set of pro forma financials using simple assumptions | |||||

| 12 | Pro Forma - Regression | Set of pro forma financials using linear trending | |||||

| 13 | Pro Forma - Exponential | Set of pro forma financials using exponential smoothing | |||||

| 14 | Scenario Analysis | Example of Scenario Analysis and Goal Seek Analysis | |||||

| 15 | Budget Analysis | Preliminary budget analysis | |||||

| 16 | Final Budgets | Set of budgets per various assumptions and forecasts. | |||||

| Note: Some additional worksheets (Answer Reports 1 & 2) may appear in the spreadsheet | |||||||

| due to the running of Solver. | |||||||

| Macros: | |||||||

| No macros have been used in this spreadsheet to give everyone some assurance that no viruses | |||||||

| are contained in the spreadsheet. However, you are free to add your own macros to save time. | |||||||

| Tools > Macro > Record New Macro | |||||||

| Excel Functions: | |||||||

| This spreadsheet uses certain financial functions (such as =TREND) which might not be | |||||||

| found in your version of Microsoft Excel. To take full advantage of financial and statistical | |||||||

| functions, you should install the Add On package titled: Analysis TookPak. Go to the main | |||||||

| tool bar, select Tools => Add-Ins => check the Analysis TookPak option, insert your | |||||||

| Excel CD and install the Analysis ToolPak. Also, you might want to install the Solver | |||||||

| Add-in since this is useful for solving special forecasting issues (such as finding the | |||||||

| optimal exponential factor). | |||||||

| Compatibility: | |||||||

| This spreadsheet was created with Microsoft Excel 2000. Older versions of Excel (such as 97) | |||||||

| may not be compatible with this spreadsheet. | |||||||

| Corrections: | |||||||

| With any “attempt” to build an Excel Model, I can easily make some mistakes. | |||||||

| So if you have suggestions to make the model better, drop me an email | |||||||

| and I’ll be glad to improve the financial model. My email address is: | matt@exinfm.com | ||||||

| General Input Panel |

|

|

|||||||

| The following general information should be entered: |

|

|

|||||||

| Note: Sample data has been entered in the input cells to help you get started. |

|

|

|||||||

|

|

|

||||||||

| 2-1 | Name of Company => | X Y Z Corporation USA |

|

|

|||||

|

|

|

||||||||

| 2-2 | Reporting Periods => | Annual | (Annual, Semi-annual, Quarterly or Monthly) |

|

|

||||

|

|

|

||||||||

| 2-3 | Number of Days in Reporting Period are | 365 | |||||||

| What reporting periods will be entered? | |||||||||

| 2-4 | Most Current Period | 2000 | (1999, July 1998, 6/30/97, etc.) | ||||||

| 2-5 | Previous Period | 1999 | (1999, July 1998, 6/30/97, etc.) | ||||||

| 2-6 | 2nd Previous Period | 1998 | (1999, July 1998, 6/30/97, etc.) | ||||||

| 2-7 | 3rd Previous Period | 1997 | (1999, July 1998, 6/30/97, etc.) | ||||||

| 2-8 | 4th Previous Period | 1996 | (1999, July 1998, 6/30/97, etc.) | ||||||

| 2-9 | Number of historical periods to be analyzed | 5 | |||||||

| How are the amounts expressed in the financial statements? | |||||||||

| (such as: in millions of dollars, thousands of Canadian dollars, etc.) | |||||||||

| 2-10 | millions of dollars | ||||||||

| Home | Balance Sheet for | |||||||||||||

| >> | > | X Y Z Corporation USA | ||||||||||||

| << | < | millions of dollars | ||||||||||||

| End | Annual | Annual | Annual | Annual | Annual | |||||||||

| Period | Period | Period | Period | Period | ||||||||||

| Ref | Description | 1996 | 1997 | 1998 | 1999 | 2000 | ||||||||

| Current Assets | ||||||||||||||

| 3-1 |

|

990 | 950 | 901 | 998 | 870 | ||||||||

| 3-2 |

|

10 | 15 | 12 | 6 | 11 | ||||||||

| 3-3 |

|

1,020 | 1,550 | 1,830 | 2,250 | 3,040 | ||||||||

| 3-4 |

|

1,005 | 1,360 | 1,650 | 1,900 | 2,060 | ||||||||

| 3-5 |

|

870 | 1,150 | 1,370 | 1,650 | 1,530 | ||||||||

| 3-6 | Total Current Assets | 3,895 | 5,025 | 5,763 | 6,804 | 7,511 | ||||||||

| NonCurrent Assets | 3-7 |

|

14,006 | 17,605 | 21,826 | 26,950 | 28,100 | |||||||

| 3-8 |

|

(1,280) | (1,700) | (2,100) | (2,550) | (3,010) | ||||||||

| 3-9 | Net Fixed Assets | 12,726 | 15,905 | 19,726 | 24,400 | 25,090 | ||||||||

| 3-10 |

|

360 | 320 | 120 | 590 | 905 | ||||||||

| 3-11 |

|

65 | 0 | 0 | 250 | 412 | ||||||||

| 3-12 |

|

100 | 110 | 105 | 135 | 195 | ||||||||

| Total Non Current Assets | 13,251 | 16,335 | 19,951 | 25,375 | 26,602 | |||||||||

| 3-13 | Total Assets | 17,146 | 21,360 | 25,714 | 32,179 | 34,113 | ||||||||

| Currrent Liab | 3-14 |

|

2,050 | 3,150 | 3,290 | 3,870 | 4,800 | |||||||

| 3-15 |

|

1,200 | 1,830 | 2,580 | 3,100 | 3,550 | ||||||||

| 3-16 |

|

12 | 15 | 25 | 30 | 36 | ||||||||

| 3-17 |

|

1,050 | 1,250 | 1,480 | 1,590 | 1,301 | ||||||||

| 3-18 | Total Current Liabilities | 4,312 | 6,245 | 7,375 | 8,590 | 9,687 | ||||||||

| 3-19 |

|

1,160 | 1,750 | 2,600 | 3,600 | 3,950 | ||||||||

| 3-20 |

|

650 | 750 | 701 | 890 | 995 | ||||||||

| Total Non Current Liabilities | 1,810 | 2,500 | 3,301 | 4,490 | 4,945 | |||||||||

| 3-21 | Total Liabilities | 6,122 | 8,745 | 10,676 | 13,080 | 14,632 | ||||||||

| Equity | 3-22 |

|

0 | 0 | 0 | 0 | 0 | |||||||

| 3-23 |

|

2,044 | 2,005 | 2,069 | 2,090 | 2,120 | ||||||||

| 3-24 |

|

5,013 | 4,900 | 5,159 | 5,626 | 5,628 | ||||||||

| 3-25 |

|

5,097 | 7,050 | 9,840 | 15,050 | 20,005 | ||||||||

| 3-26 |

|

275 | 120 | (550) | (2,147) | (6,722) | ||||||||

| 3-27 |

|

(1,405) | (1,460) | (1,480) | (1,520) | (1,550) | ||||||||

| 3-28 | Total Shareholder Equity | 11,024 | 12,615 | 15,038 | 19,099 | 19,481 | ||||||||

| Total Liabilities & Equity | 17,146 | 21,360 | 25,714 | 32,179 | 34,113 | |||||||||

| 3-29 |

|

0 | 0 | 0 | 0 | 0 | ||||||||

| Comment => | Balances | Balances | Balances | Balances | Balances | |||||||||

| Additional Information | 3-30 |

|

0 | 0 | 0 | 0 | 0 | |||||||

| 3-31 |

|

112 | 101 | 90 | 98 | 109 | ||||||||

| 3-32 | Goodwill Write Off | 0 | 0 | 0 | 0 | 0 | ||||||||

| 3-33 |

|

1,320 | 1,290 | 1,302 | 1,345 | 1,322 | ||||||||

| 3-34 | Par Value of Common Stock | $10.00 | $10.00 | $10.00 | $10.00 | $10.00 | ||||||||

| 3-35 | No of Preferred Shares o/s | 0 | 0 | 0 | 0 | 0 | ||||||||

| 3-36 | Par Value of Preferred Stock | |||||||||||||

| 3-37 |

|

$22.65 | $28.90 | $37.05 | $33.60 | $29.40 | ||||||||

| 3-38 |

|

$0.00 | $0.00 | $0.00 | $0.00 | $0.00 | ||||||||

| 3-39 |

|

0 | 0 | 0 | 0 | 0 | ||||||||

| 3-40 |

|

0 | 0 | 0 | 0 | 0 | ||||||||

| 3-41 |

|

$8.35 | $9.78 | $11.55 | $14.20 | $14.74 | ||||||||

| 3-42 | Dividends per Common Share | $1.01 | $1.49 | $1.89 | $1.75 | $1.76 | ||||||||

| 3-43 | Dividend Payout Ratio | 45.47% | 38.61% | 39.44% | 29.76% | 30.24% | ||||||||

| 3-44 |

|

0 | 0 | 0 | 0 | 0 | ||||||||

| 3-45 |

|

1,330 | 1,918 | 2,461 | 2,354 | 2,329 | ||||||||

| 3-46 | Total Dividends Paid | 1,330 | 1,918 | 2,461 | 2,354 | 2,329 | ||||||||

no reviews yet

Please Login to review.