390x Filetype XLSX File size 0.04 MB Source: assets.publishing.service.gov.uk

Financial Statements of UK Government Investments Limited

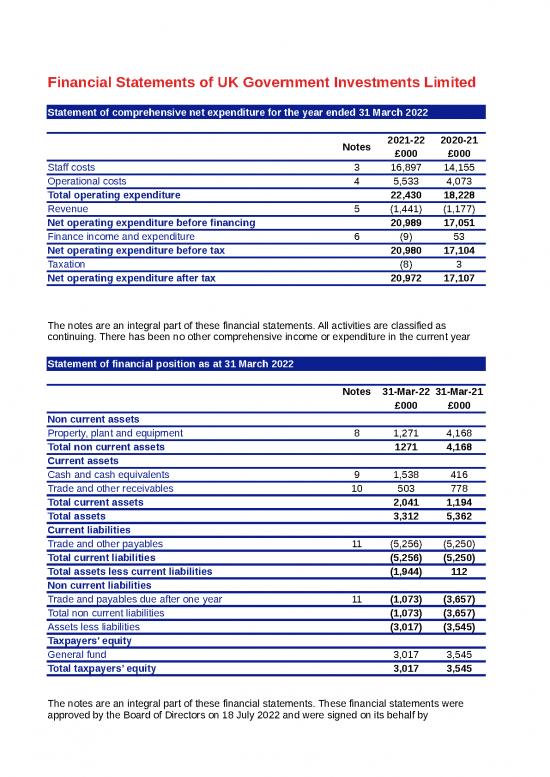

Statement of comprehensive net expenditure for the year ended 31 March 2022

Notes 2021-22 2020-21

£000 £000

Staff costs 3 16,897 14,155

Operational costs 4 5,533 4,073

Total operating expenditure 22,430 18,228

Revenue 5 (1,441) (1,177)

Net operating expenditure before financing 20,989 17,051

Finance income and expenditure 6 (9) 53

Net operating expenditure before tax 20,980 17,104

Taxation (8) 3

Net operating expenditure after tax 20,972 17,107

The notes are an integral part of these financial statements. All activities are classified as

continuing. There has been no other comprehensive income or expenditure in the current year

Statement of financial position as at 31 March 2022

Notes 31-Mar-22 31-Mar-21

£000 £000

Non current assets

Property, plant and equipment 8 1,271 4,168

Total non current assets 1271 4,168

Current assets

Cash and cash equivalents 9 1,538 416

Trade and other receivables 10 503 778

Total current assets 2,041 1,194

Total assets 3,312 5,362

Current liabilities

Trade and other payables 11 (5,256) (5,250)

Total current liabilities (5,256) (5,250)

Total assets less current liabilities (1,944) 112

Non current liabilities

Trade and payables due after one year 11 (1,073) (3,657)

Total non current liabilities (1,073) (3,657)

Assets less liabilities (3,017) (3,545)

Taxpayers’ equity

General fund 3,017 3,545

Total taxpayers’ equity 3,017 3,545

The notes are an integral part of these financial statements. These financial statements were

approved by the Board of Directors on 18 July 2022 and were signed on its behalf by

Charles Donald

Chief Executive

UKGI company number 09774296

Statement of cash flows for the year ended 31 March 2022

Notes 2021-22 2020-21

£000 £000

Cash flows from operating activities

Net operating costs (20,989) (17,051)

Depreciation 764 294

Decrease/(Increase) in trade and other receivables 10 275 134

(Decrease)/Increase in trade and other payables 11 (2,578) 5,482

Corporation tax 8 (3)

Net cash outflow from operating activities (22,520) (11,144)

Cash flows from investing activities

Purchase of non-financial assets (744) (4,462)

Revaluation of right-of-use assets 3,280 0

Gain on revaluation of non-financial assets 23 0

Net cash outflow from investing activities 2,559 (4,462)

Cash flows from financing activities

Grant-in-Aid from HM Treasury 21,500 15,750

Payment of interest and other finance expenditure 6 (14) (53)

Repayment of lease liability (403) (248)

Intercompany account movements (12)

Net financing 21,083 15,437

Net increase/(decrease) in cash and cash equivalents 1,122 (169)

in the period

Cash and cash equivalents at the beginning of the period 416 585

Cash and cash equivalents at the end of the period 1,538 416

The notes are an integral part of these financial statements

Statement of changes in taxpayers’ equity for the year ended 31 March 2022

General

Reserve

£000

Balance at 1 April 2020 (2,176)

Grant-in-Aid from HM Treasury 15,750

Comprehensive expenditure for the year after tax and transfer (17,107)

Intercompany adjustments (12)

Balance at 31 March 2021 (3,545)

Grant-in-Aid from HM Treasury 21,500

Comprehensive expenditure for the year (20,972)

Balance at 31 March 2022 (3,017)

Notes to the Financial Statements

1. Reporting Entity

UK Government Investments Limited (the Company) is a Company limited by shares

incorporated in the United Kingdom. The address of the Company’s registered office is 27-28

Eastcastle Street, London W1W 8DH.

2. Statement of Accounting Policies

The Financial Statements have been prepared in accordance with international accounting

standards in conformity with the requirements of the Companies Act 2006 and, as appropriate,

the Government Financial Reporting Manual (‘FReM’) and other guidance issued by HM

Treasury where the disclosure requirements of these go beyond the Companies Act 2006. The

financial statements have been prepared and approved by the Directors in accordance with

International Financial Reporting Standards and International Financial Reporting Interpretations

Committee interpretation.

(a) Accounting Convention

These accounts have been prepared on an accruals basis under the historical cost convention.

(b) Impact of new standards

UKGI has considered the newly issued accounting standards, interpretations and amendments to

published standards that are not yet effective. None are expected to have an impact on UKGI’s

financial statements.

(c) Going Concern

It has been considered appropriate to adopt a going concern basis for the preparation of these

financial statements as UKGI has in place an agreed budget settlement with HM Treasury,

comprising a commitment to financial year 2022-2023. UKGI’s status will be reviewed

periodically. The going concern disclosures on page 44 of the Annual Report detail in full the

basis on which the Directors consider it appropriate to prepare these Accounts on a going

concern basis.

(d) Revenue

Revenue is recognised in the statement of comprehensive expenditure on an accruals basis.

(e) Financing

The company is financed via Grant-in-Aid from HMT. The Grant-in-Aid is credited to the general

fund in the year in which it is received. The total Grant-in-Aid received by the company from HMT

in the financial year 2021-22 was £21.5m (2020-21 £15.8m).

(f) Pensions

The provisions of the Principal Civil Service Pension Scheme (PCSPS) and the Civil Servant and

Other Pension Scheme (CSOPS), are described in the Remuneration Committee Report, and

cover staff transferred from the Civil Service and who are subject to TUPE. The defined benefit

schemes within the PCSPS and CSOPS are unfunded and contributory. UKGI recognises as a

cost the monthly charges made by the PCSPS and CSOPS to contribute to the schemes.

Employees are entitled to enroll into UKGI’s group stakeholder pension plan, a defined

contribution scheme administered by Fidelity. Contributions are charged in the Statement of

Comprehensive Net Expenditure as they become payable in accordance with the rules of the

scheme.

(g) Employee benefits

The Company has accrued for the cost of the outstanding employee paid holiday entitlement.

The accrual is based on salary, Employer’s National Insurance Contributions and pension

contributions.

(h) Financial Instruments

UKGI is not exposed to significant financial risk factors arising from financial instruments.

Financial assets and liabilities are generated by day-to-day operation activities rather than being

held to change the risks facing UKGI in undertaking its activities. UKGI’s financial assets are:

trade receivables due from related parties and other trade receivables. UKGI‘s financial liabilities

are: trade and other payables due to related parties, other trade payables, lease liabilities,

taxation and social security. The carrying values of short-term financial assets and liabilities (at

amortised cost) are not considered different from fair value.

i) Market risk

Market risk is the possibility that financial loss might arise as a result of changes in such

measures as interest rates and stock market movements. The vast majority of UKGI ‘s

transactions are undertaken in sterling and so its exposure to foreign exchange risk is minimal.

UKGI’s income and operating cash flows are substantially independent of changes in market

interest rates.

ii) Credit risk

Credit risk is the possibility that other parties might fail to pay amounts due to UKGI. Credit risk

arises from deposits with banks as well as credit exposures to HM Treasury and other debtors.

The credit risk exposure to HM Treasury is considered negligible; UKGI ‘s operating costs are

recovered from HM Treasury, which is financed by resources voted by Parliament. Surplus

operating cash is only held within the Government Banking Service.

iii) Liquidity risk

Liquidity risk is the possibility that UKGI might not have funds available to meet its commitments

to make payments; this is managed through prudent cash forecasting and is considered

negligible as expenses are recouped through grant-in-aid.

(i) Tax

Value Added Tax – In general input tax on purchases is not recoverable. Irrecoverable tax is

charged to the relevant expenditure category or included in the capitalised purchase of non-

current assets. Where output VAT is charged, or input VAT is recoverable, amounts are stated

net of VAT. Corporation Tax – UKGI is liable to pay corporation tax where taxable income

exceeds the costs associated with that income. Payment of £5.6k was made to HMRC in relation

to the period 01 April 2019 to 31st March 2021 (2019-20 £4.8k).

(j) Non-current assets and depreciation

The value of the Company’s non-current assets is stated at cost less accumulated depreciation

and impairment losses. Only those assets costing more than £5,000 and having an economic

value to the Company beyond the year in which they were bought are capitalised. Where parts of

an item have different useful lives, they are accounted for as separate assets. Depreciation is

applied on a straight-line basis over the estimated useful economic lives of assets. Depreciation

methods, useful lives and residual values of non-current assets are reviewed at least at each

balance sheet date. Donated assets are recorded at nil value. Estimated useful economic lives of

non-current assets

Asset type Estimated Useful Life

Information Technology equipment Three to five years

Office furniture and fittings Ten years

Leasehold improvements The remaining period of the lease

Plant & Machinery Over ten to fifteen years

Computer software Over three years

(k) Leases

no reviews yet

Please Login to review.