225x Filetype XLSX File size 0.33 MB Source: www.maccofinancial.com

Sheet 1: Budget Mo. & Yr.

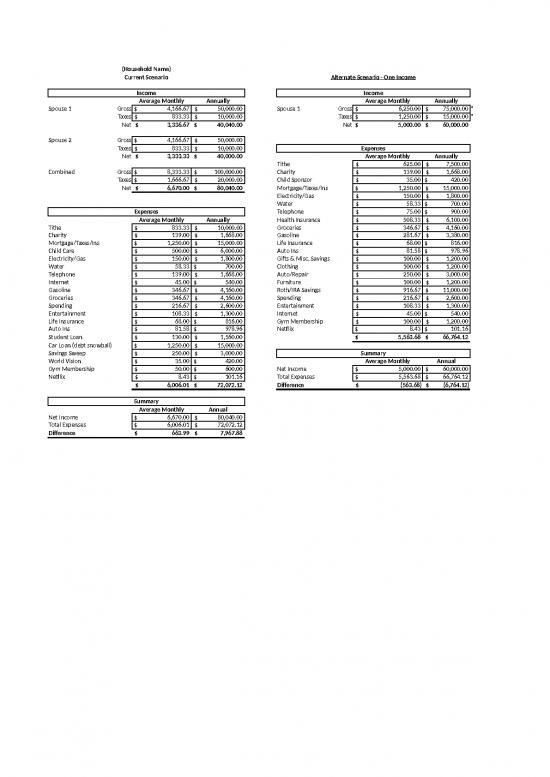

| (Household Name) | |||||||||

| Current Scenario | Alternate Scenario - One Income | ||||||||

| Income | Income | ||||||||

| Average Monthly | Annually | Average Monthly | Annually | ||||||

| Spouse 1 | Gross | $4,166.67 | $50,000.00 | Spouse 1 | Gross | $6,250.00 | $75,000.00 | * | |

| Taxes | $833.33 | $10,000.00 | Taxes | $1,250.00 | $15,000.00 | * | |||

| Net | $3,336.67 | $40,040.00 | Net | $5,000.00 | $60,000.00 | ||||

| Spouse 2 | Gross | $4,166.67 | $50,000.00 | ||||||

| Taxes | $833.33 | $10,000.00 | Expenses | ||||||

| Net | $3,333.33 | $40,000.00 | Average Monthly | Annually | |||||

| Tithe | $625.00 | $7,500.00 | |||||||

| Combined | Gross | $8,333.33 | $100,000.00 | Charity | $139.00 | $1,668.00 | |||

| Taxes | $1,666.67 | $20,000.00 | Child Sponsor | $35.00 | $420.00 | ||||

| Net | $6,670.00 | $80,040.00 | Mortgage/Taxes/Ins | $1,250.00 | $15,000.00 | ||||

| Electricity/Gas | $150.00 | $1,800.00 | |||||||

| Water | $58.33 | $700.00 | |||||||

| Expenses | Telephone | $75.00 | $900.00 | ||||||

| Average Monthly | Annually | Health Insurance | $508.33 | $6,100.00 | |||||

| Tithe | $833.33 | $10,000.00 | Groceries | $346.67 | $4,160.00 | ||||

| Charity | $139.00 | $1,668.00 | Gasoline | $281.67 | $3,380.00 | ||||

| Mortgage/Taxes/Ins | $1,250.00 | $15,000.00 | Life Insurance | $68.00 | $816.00 | ||||

| Child Care | $500.00 | $6,000.00 | Auto Ins | $81.58 | $978.96 | ||||

| Electricity/Gas | $150.00 | $1,800.00 | Gifts & Misc. Savings | $100.00 | $1,200.00 | ||||

| Water | $58.33 | $700.00 | Clothing | $100.00 | $1,200.00 | ||||

| Telephone | $139.00 | $1,668.00 | Auto/Repair | $250.00 | $3,000.00 | ||||

| Internet | $45.00 | $540.00 | Furniture | $100.00 | $1,200.00 | ||||

| Gasoline | $346.67 | $4,160.00 | Roth/IRA Savings | $916.67 | $11,000.00 | ||||

| Groceries | $346.67 | $4,160.00 | Spending | $216.67 | $2,600.00 | ||||

| Spending | $216.67 | $2,600.00 | Entertainment | $108.33 | $1,300.00 | ||||

| Entertainment | $108.33 | $1,300.00 | Internet | $45.00 | $540.00 | ||||

| Life Insurance | $68.00 | $816.00 | Gym Membership | $100.00 | $1,200.00 | ||||

| Auto Ins | $81.58 | $978.96 | Netflix | $8.43 | $101.16 | ||||

| Student Loan | $130.00 | $1,560.00 | $5,563.68 | $66,764.12 | |||||

| Car Loan (debt snowball) | $1,250.00 | $15,000.00 | |||||||

| Savings Sweep | $250.00 | $3,000.00 | Summary | ||||||

| World Vision | $35.00 | $420.00 | Average Monthly | Annual | |||||

| Gym Membership | $50.00 | $600.00 | Net Income | $5,000.00 | $60,000.00 | ||||

| Netflix | $8.43 | $101.16 | Total Expenses | $5,563.68 | $66,764.12 | ||||

| $6,006.01 | $72,072.12 | Difference | $(563.68) | $(6,764.12) | |||||

| Summary | |||||||||

| Average Monthly | Annual | ||||||||

| Net Income | $6,670.00 | $80,040.00 | |||||||

| Total Expenses | $6,006.01 | $72,072.12 | |||||||

| Difference | $663.99 | $7,967.88 | |||||||

| Gifts Given Annually by (Household Name) | ||||

| Name | Christmas | Birthday | Father's Day | Mother's Day |

| Mom | $60.00 | $30.00 | $30.00 | $- |

| Dad | $60.00 | $30.00 | $- | $30.00 |

| Mom in-law | $60.00 | $30.00 | $- | $- |

| Dad in-law | $60.00 | $30.00 | $- | $- |

| G & G 1 | $60.00 | $30.00 | $- | $30.00 |

| G & G 2 | $60.00 | $30.00 | $30.00 | $- |

| G & G 3 | $40.00 | $- | $- | $- |

| G & G 4 | $- | $- | $- | $- |

| Brother | $- | $- | $- | $- |

| Brother's Wife | $- | $- | $- | $- |

| Kid 1 | $- | $- | $- | $- |

| Sister in-law | $15.00 | $- | $- | $- |

| Brother in-law | $15.00 | $- | $- | $- |

| Kid 1 | $- | $- | $- | $- |

| Sister in-law 2 | $- | $- | $- | $- |

| Brother in-law 2 | $15.00 | $- | $- | $- |

| Kid 1 | $15.00 | $- | $- | |

| Totals | $460.00 | $180.00 | $60.00 | $60.00 |

| Total Spent all Year --> | $760.00 | |||

| January | $75.00 | |||

| February | $45.00 | |||

| March | $- | |||

| April | $- | |||

| May | $15.00 | |||

| June | $15.00 | |||

| July | $- | |||

| August | $- | |||

| September | $60.00 | |||

| October | $- | |||

| November | $460.00 | |||

| December | $30.00 | |||

| Total | $700.00 | |||

| Debt Reduction Calculator | Strategies | [42] | ||||||||||||||

| http://www.vertex42.com/Calculators/debt-reduction-calculator.html |

|

Snowball (Lowest Balance First) | ||||||||||||||

| Avalanche (Highest Interest First) | ||||||||||||||||

|

|

1/1/2016 | Order Entered In Table | ||||||||||||||

| No Snowball | ||||||||||||||||

| Creditor Information Table | Custom - Highest First | |||||||||||||||

| Row |

|

|

|

|

|

|

Custom - Lowest First | |||||||||

| 1 | Car loan 1 | 15,000.00 | 5.00% | 350.00 | 62.50 | |||||||||||

| 2 | Car loan 2 | 15,000.00 | 5.00% | 350.00 | 62.50 | Lowest Balance First: Gives you the benefit of the snowball effect, but you may | ||||||||||

| 3 | Student Loans | 40,000.00 | 5.00% | 500.00 | 166.67 | pay more interest in the end than Highest Interest First. The main benefit of this | ||||||||||

| 4 | Credit card 1 | 3,000.00 | 15.00% | 100.00 | 37.50 | approach is the psychological effect of seeing the number of debts disappear | ||||||||||

| 5 | Credit card 2 | 3,000.00 | 15.00% | 100.00 | 37.50 | more quickly. | ||||||||||

| 6 | 0.00 | |||||||||||||||

| 7 | 0.00 | Highest Interest First: This strategy results in the lowest total interest, but | ||||||||||||||

| 8 | 0.00 | depending on the balance of your higher interest loans, it may take you longer | ||||||||||||||

| 9 | 0.00 | to see your first loan/debt completely paid off. If the difference in the total | ||||||||||||||

| 10 | 0.00 | interest is not significant, than you may get more satisfaction from the Lowest | ||||||||||||||

| Total: | 76,000.00 | Total: | 1,400.00 | Balance First method. | ||||||||||||

|

|

2,000.00 | . | Order Entered in the Table: You can use the sort feature (Data>Sort) to | |||||||||||||

|

|

choose how you want the snowball effect to work. For example, if you want | |||||||||||||||

| to use a combination of Lowest Balance First AND Highest Interest First, then | ||||||||||||||||

| Strategy: | 1 | first select the creditor information table (B7:F17), then go to Data>Sort, and | ||||||||||||||

| sort by Balance:Ascending and Rate:Descending (or vice versa). | ||||||||||||||||

| Creditors in | Original | Total Interest | Months to | Month Paid | ||||||||||||

| Chosen Order | Balance | Paid | Pay Off | Off | Warning: If you are careful, you can rearrange the order of the entries in the | |||||||||||

| Credit card 1 | 3,000.00 | 103.64 | 5 | Jun-16 | . | creditor table by copying or cutting and pasting, but if you insert a row above | ||||||||||

| Credit card 2 | 3,000.00 | 236.17 | 8 | Sep-16 | . | row 1 or after row 10, the formulas will be messed up. You can cut row 1 (B8:E8) | ||||||||||

| Car loan 1 | 15,000.00 | 790.43 | 20 | Sep-17 | . | and paste it above row 3, or cut row 10 (B17:E17) and paste it above row 9. | ||||||||||

| Car loan 2 | 15,000.00 | 1,128.15 | 26 | Mar-18 | . | The calculator can handle up to 10 creditors. | ||||||||||

| Student Loans | 40,000.00 | 4,919.13 | 42 | Jul-19 | . | |||||||||||

| - | - | - | . | No Snowball: Select this option if you want to see how long it will take to pay | ||||||||||||

| - | - | - | . | off the debts without maintaining a constant monthly payment. In some cases, | ||||||||||||

| - | - | - | . | you may find it will take more than 30 years (resulting in errors in the spreadsheet). | ||||||||||||

| - | - | - | . | |||||||||||||

| - | - | - | . | Custom-Highest or Custom-Lowest: You can manually control the order the | ||||||||||||

| Total Interest Paid: | 7,177.52 | (Lower is Better) | debts are paid by entering numbers or formulas in the Custom column. For example, | |||||||||||||

| Results are only estimates | if you enter the values 1,2,3,5,4 then rows 4 and 5 will be swapped. You can enter | |||||||||||||||

| your own formulas as well, whatever they might be. | ||||||||||||||||

| Minimum Payments: This calculator does not provide the option of making only | ||||||||||||||||

| [42] | the minimum monthly payments on credit cards or lines of credit. You can find | |||||||||||||||

| an online calculator with this feature at PowerPay.org. Also see Tip #3. | ||||||||||||||||

| Tip 1: If you want to use the Lowest Balance First method and you have two debts that | ||||||||||||||||

| are close to the same balance but have very different interest rates, you may | ||||||||||||||||

| see a substantial reduction in the total interest paid if you change the order of | ||||||||||||||||

| the two entries so that you pay the higher rate first. In that case, try using the | ||||||||||||||||

| Order Entered in the Table strategy. | ||||||||||||||||

| Tip 2: Like Tip 1, if you want to use the Highest Interest Rate method, and you | ||||||||||||||||

| have two debts with similar rates but very different balances, you may want to | ||||||||||||||||

| change the order so that you pay off the lower balance first. This may make very | ||||||||||||||||

| little difference in the total interest, but it can make you feel better faster. | ||||||||||||||||

| Tip 3: Update the Creditor Information Table every few months. Your minimum | ||||||||||||||||

| payments may change over time as the balance in your accounts change, or if your | ||||||||||||||||

| interest rate changes. You may be able to further reduce your overall interest and | ||||||||||||||||

| reduce the time to pay off your debts, by re-adjusting your minimum payments | ||||||||||||||||

| every few months. This would mean starting over with a fresh template, entering | ||||||||||||||||

| the new Balance Date, and updating the Creditor Information Table. | ||||||||||||||||

| Tip 4 - Snowflaking: This is a popular new term given to making occasional extra | ||||||||||||||||

| payments above the normal monthly payment. You can add debt "snowflakes" in the | ||||||||||||||||

| PaymentSchedule worksheet. | ||||||||||||||||

no reviews yet

Please Login to review.